Benefits of running a Loyalty Program for Banking & Financial Institutions

FinTech companies have emerged as the new digital disruptors. They have transformed the financial services sector by being the torch bearers of digitization, redefining customer engagement, and delivering better customer experiences.

It’s not just financial organizations that have switched gears. Customers have also become more conscious of the quality-of-service deliveries. If a financial organization’s engagement strategy is not personalized, relevant, and rewarding, then even long-standing customers are likely to give them a pass.

As competition heats up in the BFSI landscape (Banking, Financial Services, and Insurance), acing customer retention has become imperative. One of the ways organizations are doing this is by introducing loyalty programs that are focused on customer connect across platforms and touchpoints, offering personalized rewards, and fostering long-lasting customer relationships.

As financial institutions seek new ways of improving user perception and become trusted partners for their customers, they are increasingly turning to technologies that help build stronger relationships with their users. Next-generation loyalty technology providers like Easyrewardz are rewriting the rules of customer engagement for the BFSI sector. AI-powered loyalty tools have made rewards personalized and created new touchpoints that engage customers outside of the buying cycle.

Reward program in the card industry have been well established for some time, but now financial service providers are pushing for it in other products to shift customer behavior.

Bank loyalty programs are increasingly finding favor with customers. A study found that 81% of BFSI users expect incentives like signup bonuses. As banks look at boosting retention and meeting customer expectations, digitally-driven loyalty programs are emerging as a great enabler.

What’s more, with banking and financial services increasingly transitioning from a physical to an online space, digital banking services are rolling out lucrative loyalty programs that reward customers every time they transact with a bank. Digital banking reward programs are becoming a great way for financial institutions to forge meaningful relationships with their customers even as they go about meeting their day-to-day banking needs.

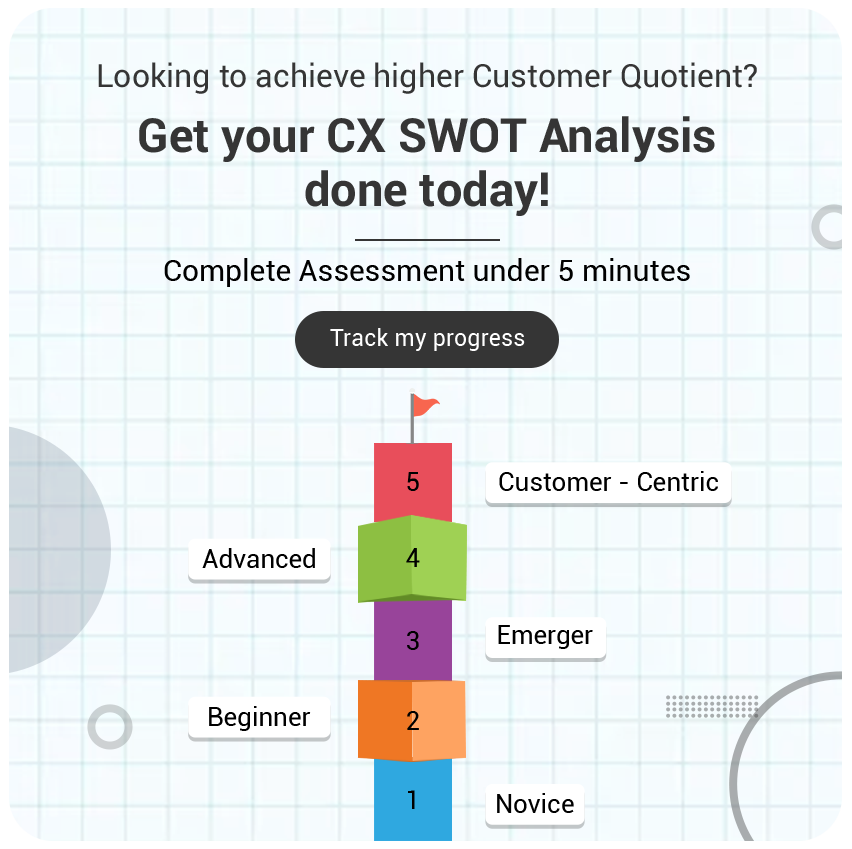

In this blog, we will explore how bank loyalty programs work and how they help drive customer engagement and why CX-driven loyalty programs have become a critical customer retention tool for BFSI players.

What is a Financial Services Loyalty Program?

Banks and other financial organizations are increasingly using loyalty programs as an effective tool to retain customers by offering them relevant, and personalized rewards. This gives them a competitive advantage and helps them retain existing customers and convert new ones.

Banking loyalty programs offer a wide range of lucrative incentives to customers, including experiential rewards, flexible redemption rates, vouchers & deals, OTT subscriptions and more. Such perks can turn into crowd-pullers for financial institutions. If customers feel they’re winning prized rewards from an organization, they will keep coming back for more, and engage more with the reward program.

Financial services loyalty programs are customer retention tools that aim to increase brand affiliation and transaction frequency. These programs serve different features including:

- They incentivize members to spend using their bank cards and help cross-sell & up-sell other product offerings.

- Loyalty programs aim to have a thorough structure. Moreover, they entertain customers with numerous incentives, including loyalty points, experiential rewards and more.

- It creates an omnichannel perspective for users and let them redeem rewards through all channels.

- BFSI loyalty programs timely bring new offers and deals so that a customer shows stickiness.

Why technology-driven reward programs have become critical for BFSI players

CX is emerging as the bedrock of most customer loyalty programs. It helps financial organisations provide seamless, omnichannel, and personalised reward and access to their customers. In fact, with the advent of these tech-powered, tailor-made reward bonanzas, traditional loyalty programs are beginning to lose their sheen.

Technology-driven loyalty programs are also becoming the new go-to toolkit for BFSI players as they sync better with the customer-centric focus that drives modern-day digital banks. It helps get customer access to the program, wherein they are not dependent on the monthly statement to identify the transactions and benefits

Digital is the way ahead and AI-powered loyalty toolkits are emerging as the best fits for the sector.

Here are some reasons why tech-driven loyalty toolkits are gaining traction among BFSI companies, and fast.

Your customers have gone digital

Customers today are more digital than ever before. They are looking for the best deals from banks and insurance companies while online. And if you aren’t on the top of the list, even your most long-standing customers will bid you goodbye.

Meet your customers where they are

BFSI has grown into a very competitive market. Without a solid customer retention tool like an omnichannel loyalty program experience that addresses customers needs, it is easy for them to switch to a competitor that is offering more attractive deals.

Add value to your loyalty program

Customers aren’t interested in loyalty programs that don’t add value to their lives consistently, even after key transactions are made. Technology-powered loyalty solutions like Easyrewardz can personalise rewards and offer optimum value to customers.

Know Your Customer

Today it’s all about knowing your users. Customers no longer give weightage to loyalty programs that don’t focus on their behaviors and expectations. Advanced customer behavior analytics and insights help BFSI players know their users’ preferences, likes, and dislikes.

Engage emotionally

Loyalty in the BFSI sector needs to be about emotional engagement, and next-gen loyalty programs are the perfect way to grow this engagement. By creating new touchpoints companies can show that they care about their customers and want to learn more about them.

Go omnichannel

When you know what is the preferred platform or touchpoint to meet your customer and the best deals that will steal their heart, you will engage better with both your new and existing customers – and achieve better results. And this is best done with a digitally-driven loyalty solution.

How CRM can take BFSI loyalty programs to the next level

The core job of a Customer Relationship Management (CRM) solution is to help gather customer insights to create a single view across the customer’s relationship. Loyalty helps in delivering a standard currency for the to incentivize customers for showing profitable behaviour, drive cross-sell and upsell, increase customer stickiness, and offer a variety of rewards basis the customer persona.

Financial institutions are constantly looking for new ways to improve customer relationship and raise brand awareness which BFSI-driven CRM solutions enable them via right-fitting loyalty programs. How do they do this?

How CRM & Loyalty can take BFSI offerings to the next level

The core job of a Customer Relationship Management (CRM) solution is to help gather customer insights to create a single view across the customer’s relationship. Loyalty helps in delivering a standard currency for the to incentivize customers for showing profitable behaviour, drive cross-sell and upsell, increase customer stickiness, and offer a variety of rewards basis the customer persona.Financial institutions are constantly looking for new ways to improve customer relationship and raise brand awareness which BFSI-driven CRM solutions enable them via right-fitting loyalty programs. How do they do this?

Leverage Single View of Customer

CRM & Loyalty solution leverage customer data to ensure you are always in touch with the real-time performance of your loyalty programs. This provides financial institutions with a 360-degree view of their customers’ loyalty transactions, helps them manage membership accounts, and organise user data effectively using a unified dashboard.

How Easyrewardz CRM solution delivers customer insights

It offers a `one customer’ view across products, helping BFSI players design and manage a tailor-made loyalty program that is relevant and useful to their users.

Personalisation for better engagement

Engage new and existing customers with personalised communication to create a better connect with them. CRM solutions offer an outstanding personalisation feature that engages customers on their preferred channel of communication.

How Easyrewardz CRM solution delivers a tech-driven, personalised reward experience

The toolkit empowers financial organisations to reward customers for their value and width of relationship. It also helps banks stay connected with customers via data-led communication, personalised engagement via SMS, WhatsApp, and Chatbots, and interact with customers via loyalty program microsites. This builds a personal and emotional connect between a bank and its customers, which forms the basis of a long-standing relationship.

Omnichannel approach to add flexibility

Customers look for seamless experiences and an omnichannel approach to loyalty enables them to earn and redeem rewards via all channels. Right-fitting CRM solutions allow financial organisations to stay in touch with their customers across all touchpoints of a loyalty program. Banks can send personalized or broadcast communications to their users. They can send surveys and collect feedback which can help them improve the quality of their loyalty program.

How Easyrewardz turns BFSI loyalty omnichannel

The CRM solution touches key channels including microsites and web-based Apps to keep users engaged. This multi-channel approach helps financial organisations create, cross-sell and up-sell opportunities based on targeted segments.

Meaningful rewards

CRM solutions help create customer personas basis which financial institutions can reward and recognize their customers with meaningful rewards. It enables them to curate a bouquet of rewards to give their customers ‘the power of choice’, this helps in building brand affinity as the customers feel rewarded for engaging and recognized for transacting with the financial institution, thus leading to delightful banking experiences.

Sum Up: Give your customer retention strategy a rewarding push

Deploying robust and tailor-made loyalty programs have become a must for modern digital banking organisations. The right Rewards Strategy can help drive profitable customer behaviour thus leading to Loyalty Program goals mirroring your Business KPIs Loyalty programs are emerging as a great way for banks to tell their customers they care, which in turn optimizes engagement, boosts retention, and helps them tower over the competition.