Topic -Transforming Banking Experience in the Digital Era

BFSI: The World of Hyper-Personalization

Resilience and agility: These two words define the character of BFSI sector during the pandemic. However, now more than ever the sector needs to adapt and innovate to deliver seamless customer experience to the new age customers i.e. the millennials and Gen Z who have their own set of expectations. It is now up to the financial institutions to figure out how they want to serve the customers in their preferred way. Hyper-Personalization has already become the benchmark for creating product globally – it is time now for Indian BFSI sector to adopt the same.

Insight Talk by Soumya on Transforming Banking Experience in the Digital Era

Digital revolution in the BFSI sector started around 10 years back with the introduction of IMPS, online wallets and the launch of Paytm. This was followed up by the government setting up the NPCI through which came the RUPAY Card. This Fintech revolution has let to a plethora of new digital banks arriving on the scene. Although these banks are not RBI approved, they have managed to create a niche for themselves by allowing online transactions and limiting branch visits, and thus attracting the Millennial and Gen Z customer base. The advent of UPI has also had a major impact towards our push for a digital economy.

UPI has been a game changer, while it is still linked with the debit product, the impact is visible on the credit product as well. The biggest casualty of UPI is the Debit Card with the former being much simpler to carry. Another recent phenomenon in BFSI sector is Buy Now Pay Later (BNPL) – given a push by demonetization and the pandemic, BNPL is slowly replacing Credit Card EMI plans.

For corporate banking, P2P lending concept has also grown with specialized wallets & apps enabling P2P lending and thus the reducing the need for consumers to visit the bank. The rise of NBFCs with simpler regulations have also changed the corporate banking sector. All of these factors are chipping away from the traditional banks. Amidst all of this innovative chaos, how does a bank stay relevant?

Banks have two options, they can either innovate and build an ecosystem from scratch or partner with a Fintech company where traditional bank takes care of the backend and new bank takes care of CX. Banks need to provide better CX – where visiting the branch is optional. The future of customer service like any other industry is AI bots experience and self-serve experience and banks need to have wherewithal to develop the channel to

empower bots.

Easyrewardz BFSI Solution

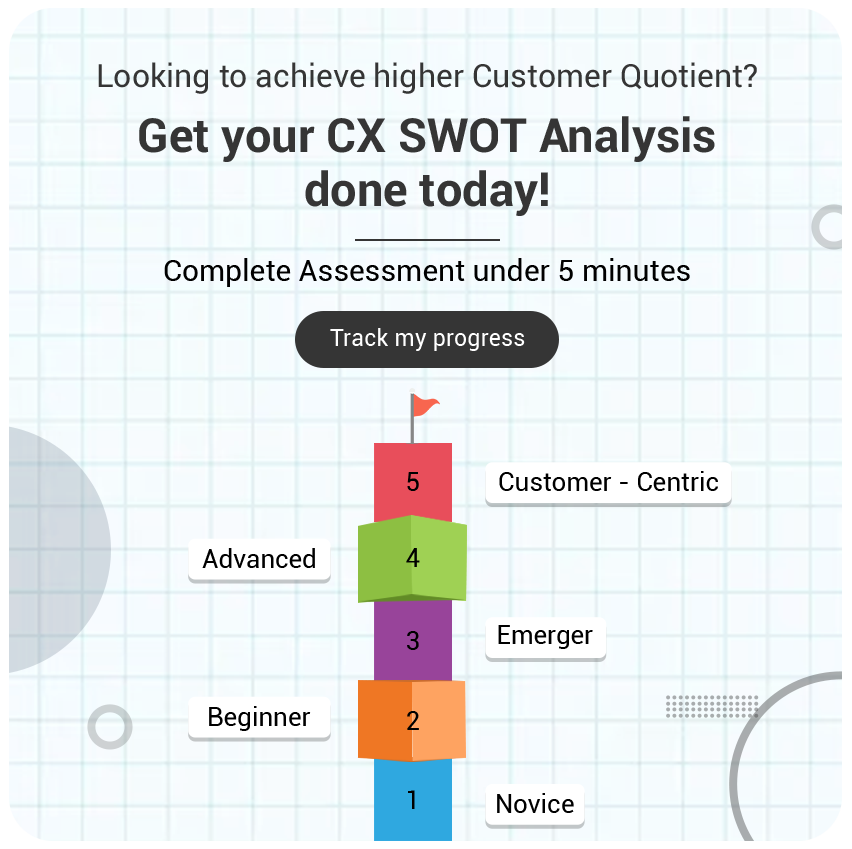

Comprehensive solution for BFSI including understanding customer behavior, crafting customer life cycle journey, automating campaigns with a bespoke loyalty program. Leverage our inbuilt strategy to deliver seamless CX both offline & online. Access 360° view of customer, define wallets, currency and milestones for the program, and delight customers with a plethora of redemption options from our specially curated reward catalogue.