Easyrewardz > Resources > Blog > Blog > 5 Customer Retention Strategies to Implement for the Finance Tech Industry in 2024 & Beyond

5 Customer Retention Strategies

Implement for the Finance Tech Industry in 2024 & Beyond

In the fast-paced world of finance and technology, where every company is implementing digital strategies and cutting-edge technologies, there is one way to incorporate sustainability and growth to your business i.e. customer retention. According to the Gartner report, 70% of CMOs, CSOs, and more than half of general managers believe that their revenue is derived from existing customers. As a result, customer retention has become increasingly crucial for brand success.

But first, let’s begin with understanding why customer retention strategies have played a crucial role in recent times.

According to NeilPatel, the cost of gaining customers has climbed by 60%, and businesses are experiencing numerous obstacles. The one way to be cost-effective is to retain customers. It costs 5 to 25X less than acquiring new customers. Customer retention is all about developing and keeping customer connections. By managing these relationships, you will have an opportunity to interact with prospects. Customers who are loyal to your brand can become spokespersons.

But first, let’s begin with understanding why customer retention strategies have played a crucial role in recent times.

According to NeilPatel, the cost of gaining customers has climbed by 60%, and businesses are experiencing numerous obstacles. The one way to be cost-effective is to retain customers. It costs 5 to 25X less than acquiring new customers. Customer retention is all about developing and keeping customer connections. By managing these relationships, you will have an opportunity to interact with prospects. Customers who are loyal to your brand can become spokespersons.

5 Strategies to Improve Customer Retention in 2024

1. Personalization and Customization

Surveys suggests four out of five consumers would share some type of personal data for a better experience. Therefore, now brands are willing to analyse this data to serve better personalised experience and retain customers.

Hyper personalization is one of the most effective techniques for fintech organisations to match the specific needs, interests, and goals of each customer. This technique not only helps businesses provide a better customer experience, but it also helps them create more income by retaining existing consumers. According to Mckinsey’s research, organisations that thrive in personalization earn 40% more revenue than organisations that do not use personalization tactics.

Tech finance businesses are using AI (artificial intelligence) and ML (machine language) technologies to analyse consumer data, which goes beyond demographic data, including transaction history, spending trends, and preferences. The analysis helps them to customise solutions and entice them to use their service again.

Tech finance businesses are using AI (artificial intelligence) and ML (machine language) technologies to analyse consumer data, which goes beyond demographic data, including transaction history, spending trends, and preferences. The analysis helps them to customise solutions and entice them to use their service again.

A. Chatbots using generative AI to answer questions in real-time

Gen AI-based chatbots are intelligent and adaptable enough to comprehend consumer inquiries and provide them with pertinent answers instantly. By eliminating obstacles in the customer journey and providing a seamless experience, these chatbots aid in gaining the loyalty of customers.B. Providing personalised financial recommendations using GenAI

By meticulously analysing historical data and the prevailing market conditions, AI can provide customers with investment recommendations that align with their financial goals and risk tolerance. By offering personalized recommendations and timely insights, AI enhances the overall customer experience as customers feel valued, leading to improved customer satisfaction and loyalty. Additionally, AI employs feedback loops to improve accuracy and relevance of its recommendation over time.2. Implementing a Loyalty Program

Business Wire has quoted that 64% of customers are willing to pay in exchange for additional benefits like discounts, and 70% of paid loyalty program members cite free shipping as a key motivation for joining.

This makes Loyalty programs a big-time YES to retain customers. These programs are a ticket to your customer retention and financial tech companies are leveraging loyalty programs to increase revenue. According to BusinessWire, over 71% of companies invest at least 2% of their total revenues into loyalty programs.

A strong tool for turning financial transactions into an engaging user experience is a loyalty program. Every program, whether it be tiered, point-based, cash-back, or referral-based, has the power to attract consumers, hold their interest, and encourage them to return to your business.

This makes Loyalty programs a big-time YES to retain customers. These programs are a ticket to your customer retention and financial tech companies are leveraging loyalty programs to increase revenue. According to BusinessWire, over 71% of companies invest at least 2% of their total revenues into loyalty programs.

A strong tool for turning financial transactions into an engaging user experience is a loyalty program. Every program, whether it be tiered, point-based, cash-back, or referral-based, has the power to attract consumers, hold their interest, and encourage them to return to your business.

Leveraging Easyrewardz LPaaS comprehensive toolkit empowers brands to delight, engage, and reward customers. The unique loyalty platform can help brands increase memberships and drive repeat sales through points, coupons, and gift vouchers.

3. Building a community around the brand

Are you thinking about how building a community can be the masterstroke for customer retention?

Here is the answer!

In 1983, Harley-Davidson almost became extinct. Twenty-five years later, the business possessed a $7.8 billion global brand that ranked among the top 50. Harley’s dedication to creating a brand community—a group of devoted customers centred around the brand’s lifestyle, activities, and ethos—was essential to the company’s turnaround and success that followed. Today’s customer yearns for an honest connection with the brand. Customers are now more involved with financial institutions than just the transaction value. Building community and contributing to the well-being of community members help brands to build loyalty and retain customers.

Here is the answer!

In 1983, Harley-Davidson almost became extinct. Twenty-five years later, the business possessed a $7.8 billion global brand that ranked among the top 50. Harley’s dedication to creating a brand community—a group of devoted customers centred around the brand’s lifestyle, activities, and ethos—was essential to the company’s turnaround and success that followed. Today’s customer yearns for an honest connection with the brand. Customers are now more involved with financial institutions than just the transaction value. Building community and contributing to the well-being of community members help brands to build loyalty and retain customers.

4. Implementing CDP (Customer Data Platform) and integrated systems

Financial institutions utilise CDP to safely capture interactions across the customer journey. Additionally, it facilitates the creation of a simple consumer view across all channels. By investing in a CDP, brands are able to deliver more focused experiences and are able to go beyond their present capabilities of utilising and maintaining customer data. This was made possible by the ability to segment audiences.

Here’s how tech finance companies can use CDP to keep customers –

Here’s how tech finance companies can use CDP to keep customers –

- Personalization: It facilitates the creation of appealing and customised campaigns for each user.

- Segmentation: It assists in developing a distinct segmentation according to a range of factors, including purchasing history, behaviour, and demographics. Brands can tailor their sales and marketing efforts based on the segments.

- Cross-channel marketing: Monitor consumer interactions on many platforms and channels to better plan marketing strategies and provide a unified, smooth customer experience.

Still confused about implementing CDP in your business? Discover Easyrewardz CDP Solution to gather actionable insights and make data-driven decisions, leading to improved brand advocacy.

5. Flawless Customer Experience

Consumers don’t want their journey to be complicated. Retaining customers is made easier by simplifying their journey and experience. Businesses are putting money into enhancing customer experience (CX), which enables tech finance firms to greatly increase customer happiness and loyalty, spurring expansion and retention. There are a few ways that financial tech firms can use to provide flawless customer experience.

A. Engagement through Omni channel

The integration of multiple channels like websites, social media, mobile apps, and in-person service has tremendously elevated customer experience and accessibility. To give a seamless and customer-centric experience to customers, you can partner with Easyrewardz and deliver connected customer experiences across all customer touchpoints.B. Implementing UX strategies in fintech products

Customer retention can be improved by providing seamless, easy-to-use, and joyful experiences through digital platforms. Existing customers are keen to explore new services and products if you have an intuitive product design and clearly defined call-to-action buttons. Resolving UX issues and implementing UX practices facilitates easy navigation and contributes significantly to customer retention and long-term success.

Final Words

In 2024, customer retention is not only about maintaining relationships but it’s also about constantly delivering value and adapting to customers’ needs. From implementing UX practices, and understanding customer journeys to discovering new loyalty program strategies and implementing CDP, financial institutions are using the above-mentioned retention strategies to lay a strong foundation of growth.

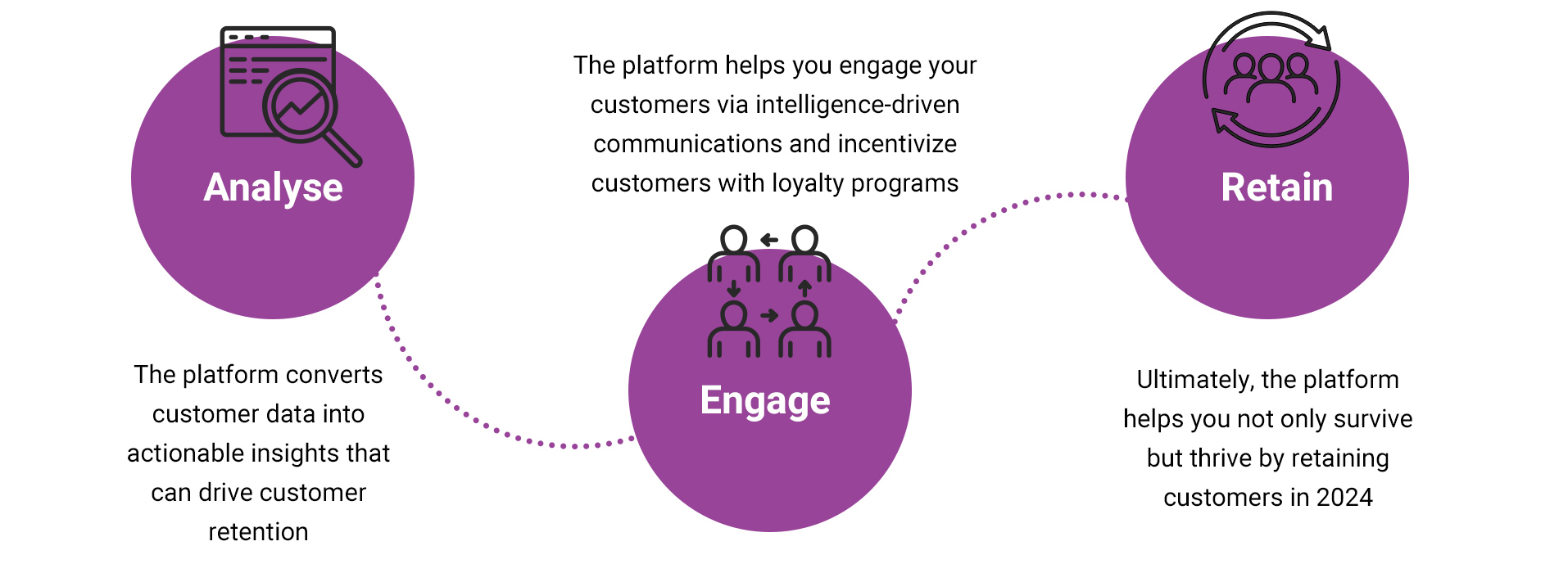

How can Easyrewardz help?

Easyrewardz can be your saviour if you’re considering using the above techniques to retain your customers in 2024.

Are you ready to unlock the customer retention power?

Let’s connect where we empower you to bring home higher returns.